But some relatively simple strategies can produce reliable income without a lot of effort and without requiring moment-to-moment monitoring of a position.

The one I'll discuss today is the Iron Condor:

Basically, you:

- Buy a put, strike price A

- Sell a put, strike price B

- Sell a call, strike price C

- Buy a call, strike price D

This is essentially the combination of a put credit spread and a call credit spread. You make a profit if the price of the underlying stock (or ETF or index fund) remains roughly between B and C at expiration.

The return on capital one can make with this trade depends on several factors, but the one we're going to focus on today is the width between strikes B and C. Basically we're going to choose these strikes such that there is about an 87% chance that the stock will finish between these strikes when the options expire. But we plan to close this spread before expiration, when it's achieved about 50% of its maximum credit. This makes the chance for profit more like 95 to 96%.

How do we figure this initial 87%? We use the normal curve:

See where the 1.5 and -1.5 marks are? That's where we want to choose the short strikes.

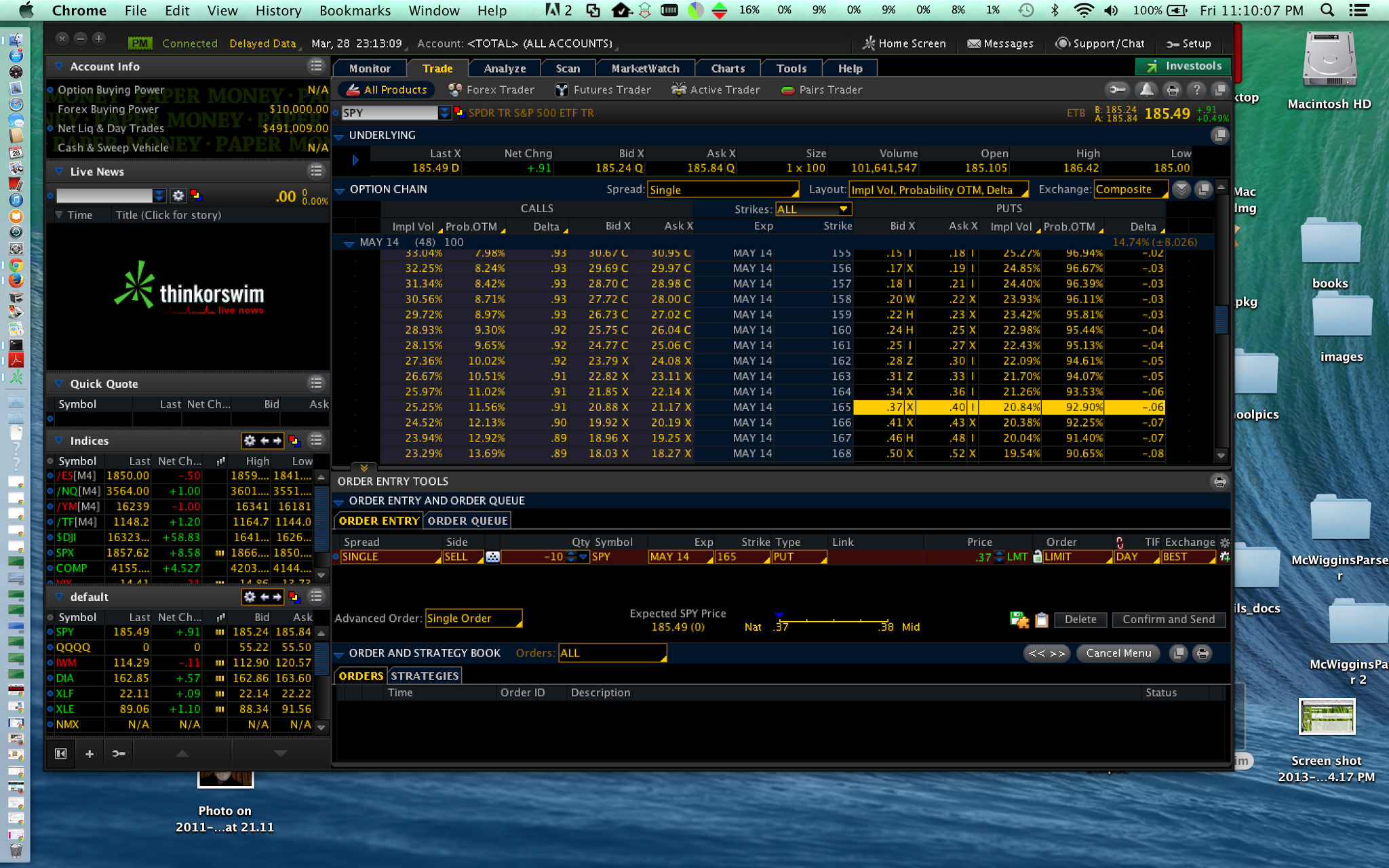

Let's look at an example ETF: SPY, the S&P 500 index ETF. If you set up the main trade screen to show %OTM (percentage out of the money), you're looking for something in the range of 92 to 93% probability:

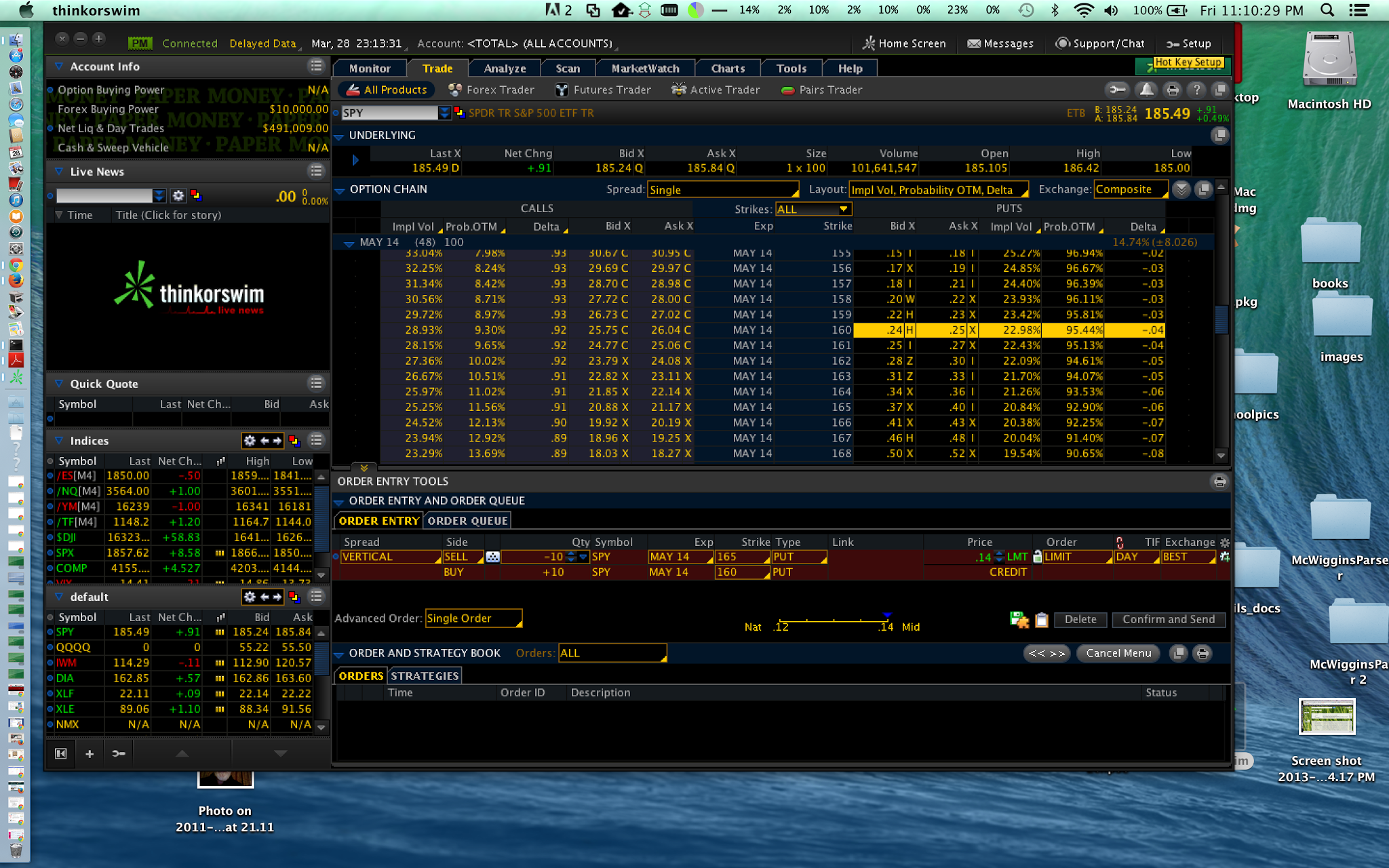

This is the short put we started with; now we need to buy the same number of puts at least one strike away. Let's choose 5 wide, as this gives us more credit (in Thinkorswim, one holds down the CTRL key to build up a multi-leg spread one leg at a time.)

Now we look for the same 92 to 93% probability on the call side:

And choose the long strike 5 points away on that side too:

Here's where we calculate the yield:

300 / 4660 = 6.4% ... so if we close the trade when we get 1/2 that, that's 3.7%.

Suggestions for beginning this: start small! Use 1 contract SPY (instead of the 10 I'm using here). Your max loss would then be $466 instead of $4660. Try this for a couple of months. Then move to 5 contracts, then 10 ...

When you're comfortable trading 10 SPY's, try 2 SPX. SPX is 10 times larger than SPY, and trading it is a little different in that it's not (currently) automated. It's "open outcry," meaning humans are still involved in the trades. You'll have to move 25 to 75 cents away from the midpoint to get SPX condors executed.

How big do you go with this? Just decide how much income you want to make and size accordingly. Using this example ... if you want to make $3000 per month you'll need a 20X larger trade, which means 20 contracts of SPX.

Happy trading!