I guess the trend of this kind of office has peaked since Microsoft just started doing it. (A friend of mine just left the Visual Studio team there as they were planning this shift.)

And Scott Adams has his barbed pen aligned with mine:

I'm just about to move into options trading for a living (I think) so this will no longer be an issue for me. But anybody who hates to sit in this kind of space will have to look for a telecommuting gig or for one of the few places that still offers developers a modicum of privacy.

Wednesday, December 11, 2013

Sunday, November 17, 2013

Options Trading 101: Some helpful resources on video and other recommendations

I've posted several suggestions for book to read and brokerages to consider for beginning traders. But there are a couple of video resources that are worth a look for anybody just considering trading options.

First: Tradeking's Youtube Series. These run around 8 minutes each and start from the bottom, explaining puts and calls and what they represent, and emphasizing mistakes that many beginners make.

Second: Tastytrade. This is a phenomenal resource, with the founder of ThinkOrSwim, Tom Sosnoff and some colleagues broadcasting a mix of market news, options trading studies, beginner info, and more. Beginners should focus on "Where should I start?" and the "Liz and JNY" show as well as several other beginner's segments. If you subscribe with an email address they will send you a daily highlight list. They broadcast from 7 to 3 Central Time every trading day, so not possible for most folks to watch it all in real time. But they archive everything so you can pick and choose what you want.

And finally today: the two insights on options that I wish I'd had starting out:

First: Tradeking's Youtube Series. These run around 8 minutes each and start from the bottom, explaining puts and calls and what they represent, and emphasizing mistakes that many beginners make.

Second: Tastytrade. This is a phenomenal resource, with the founder of ThinkOrSwim, Tom Sosnoff and some colleagues broadcasting a mix of market news, options trading studies, beginner info, and more. Beginners should focus on "Where should I start?" and the "Liz and JNY" show as well as several other beginner's segments. If you subscribe with an email address they will send you a daily highlight list. They broadcast from 7 to 3 Central Time every trading day, so not possible for most folks to watch it all in real time. But they archive everything so you can pick and choose what you want.

And finally today: the two insights on options that I wish I'd had starting out:

- It isn't necessary to hold options to expiration to make money; in fact it's generally a detriment. I read every book in the local library without coming across this; almost every book for amateurs that I've seen assumes holding everything to expiration. But you can make plenty of money and take far less risk by selling out the position before it expires (in almost all cases.)

- You might think that an in-the-money option moves at the same rate as the stock, but it doesn't. It may move only 50% or 70% as fast; this ratio is called its delta. This is something I didn't get for the first couple of years and it cost me dearly!

Happy trading!

Friday, October 4, 2013

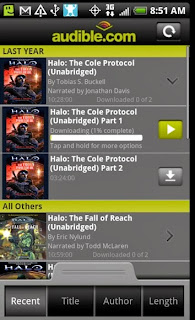

Amazon destroyed the Audible Android App ... but I found something better!

I have generally become cavalier about downloading updates to the apps on my Android phone. So I didn't think much of it when I had a series of updates to the Audible app.

I understand that the first versions of the Android Audible apps were written after Amazon bought Audible, and they were usable if not spectacular:

It did allow you to download Audible-purchased books directly to the phone and it performed

reasonably in most respects. I never looked for an alternative book player for this phone, though a friend of mine kept raving about an alternative.

The most recent update of this app, though ...

... slowed down (at least on my 2011 phone) to the point it was unusable. It changed to a 'wait -- loading' type screen every time I changed the orientation of the phone. I found it maddening.

I went back to my friend with the alternative and listened to what he had to say. He uses Ambling Book Player Pro:

I bought a copy ($8.99). This works, it's fast ... but it does require a different piece of software to break the DRM copyright on Audible-format books. There are several out there. My friend is a PC user who runs Sound Taxi. I mostly use a Macintosh and found a similar Audiobook Converter from Macsome ($34.95). It actually runs much faster than SoundTaxi (though still takes a few hours to convert a 20-hour audiobook on my 2008 Macbook.)

The overall usage is more complex than for the Audible app; you have to

I understand that the first versions of the Android Audible apps were written after Amazon bought Audible, and they were usable if not spectacular:

It did allow you to download Audible-purchased books directly to the phone and it performed

reasonably in most respects. I never looked for an alternative book player for this phone, though a friend of mine kept raving about an alternative.

The most recent update of this app, though ...

... slowed down (at least on my 2011 phone) to the point it was unusable. It changed to a 'wait -- loading' type screen every time I changed the orientation of the phone. I found it maddening.

I went back to my friend with the alternative and listened to what he had to say. He uses Ambling Book Player Pro:

I bought a copy ($8.99). This works, it's fast ... but it does require a different piece of software to break the DRM copyright on Audible-format books. There are several out there. My friend is a PC user who runs Sound Taxi. I mostly use a Macintosh and found a similar Audiobook Converter from Macsome ($34.95). It actually runs much faster than SoundTaxi (though still takes a few hours to convert a 20-hour audiobook on my 2008 Macbook.)

The overall usage is more complex than for the Audible app; you have to

- download the book to the computer

- load it into iTunes (the only way Macsome will grab it, trying to look non-pirate!)

- run Macsome

- connect the phone to the computer,

- copy the converted files (Note! one book per directory)

- run Ambling to load books from the location in your phone where you stored them

But worth it! At least on this phone. I am planning a phone upgrade early next year and will review all apps then, but for the moment this works for me.

Happy listening!

Friday, April 5, 2013

Lois McMaster Bujold and Miles Vorkosigan

I stumbled into Lois McMaster Bujold's writings working my way through Hugo and Nebula winners. I started with the Audible version of this one, the 1991 Hugo winner:

The protagonist, Miles Vorkosigan, is a pint-sized (4 feet 9 inches tall) brilliant military genius who has just won his Lieutenant's bars after years of struggle past his physical problems (the result of a toxic attack on his mother while he was in utero) to get through Barrayar's military academy. He finds himself posted not to a starship but to the arctic outpost "Camp Permafrost", where he experiences near homicidal hazing, a sociopathic commanding officer, and "wah-wah" winds that can go from zero to 160 kilometers per hour in a flash. Exciting!

I found the Miles character so entertaining and compelling that I've now just about finished the entire series, which has Miles going through life as a covert agent, Imperial Auditor, faux Admiral of a mercenary fleet, and more.

The universe Miles lives in is also interesting. There is faster-than-light travel via wormhole, but wormholes are a natural feature that sometimes disappear without warning ... cutting off Barrayar, Miles' home world, off from the rest of the galaxy for a long Time of Isolation. Then a wormhole

route was found, but controlled by a usurious and perfidious world Komarr, who charges excessive rates for transit through the wormhole ... and lets the Cetagandans in through that wormhole to attack Barrayar ...

The other substance in play is "Fast Penta" a truth-evoking drug (for most) that acts quickly and irresistibly, letting the authorities tell the sheep from the goats without torturing either ...

I've just finished two books toward the end of the series:

These were very highly rated by Audible listeners (4.6) and I understand why! These two introduce Miles' clone and ... the woman it looks like he will wind up marrying! (Under fast penta she says "What would it be like to go to bed with somebody I actually liked?")

Indeed! If you haven't tried Miles, try one at random, or start at the beginning. You won't be disappointed.

The protagonist, Miles Vorkosigan, is a pint-sized (4 feet 9 inches tall) brilliant military genius who has just won his Lieutenant's bars after years of struggle past his physical problems (the result of a toxic attack on his mother while he was in utero) to get through Barrayar's military academy. He finds himself posted not to a starship but to the arctic outpost "Camp Permafrost", where he experiences near homicidal hazing, a sociopathic commanding officer, and "wah-wah" winds that can go from zero to 160 kilometers per hour in a flash. Exciting!

I found the Miles character so entertaining and compelling that I've now just about finished the entire series, which has Miles going through life as a covert agent, Imperial Auditor, faux Admiral of a mercenary fleet, and more.

The universe Miles lives in is also interesting. There is faster-than-light travel via wormhole, but wormholes are a natural feature that sometimes disappear without warning ... cutting off Barrayar, Miles' home world, off from the rest of the galaxy for a long Time of Isolation. Then a wormhole

route was found, but controlled by a usurious and perfidious world Komarr, who charges excessive rates for transit through the wormhole ... and lets the Cetagandans in through that wormhole to attack Barrayar ...

The other substance in play is "Fast Penta" a truth-evoking drug (for most) that acts quickly and irresistibly, letting the authorities tell the sheep from the goats without torturing either ...

I've just finished two books toward the end of the series:

These were very highly rated by Audible listeners (4.6) and I understand why! These two introduce Miles' clone and ... the woman it looks like he will wind up marrying! (Under fast penta she says "What would it be like to go to bed with somebody I actually liked?")

Indeed! If you haven't tried Miles, try one at random, or start at the beginning. You won't be disappointed.

Friday, February 15, 2013

The principle of least aggravation

I've been trading options for almost 4 years now, with intermittent success. I think I've finally found a winning strategy, thanks to Dan Sheridan and his team, from whom I learned not to fear "adjustments" and other valuable skills.

As I learned, I came to be interested in slightly nonstandard trades and to understand what features are desirable in a brokerage. I've tried four different brokerages now, and three have what I consider to be fatal flaws (for my purposes, anyway), so that leaves me with the fourth, which I'll discuss at the end of this post.

I spent 2+ years trading via OptionsXpress. There's a lot to like about this site: the UI is in many ways very nice, automatically doing things for you that should be automated (like adjusting the expiration dates on a butterfly spread to match when you change one of the wings).

Its fatal flaw, though, is being too inflexible about not-quite-standard trades, like the 1-4-3 butterfly I mentioned here last year. It also has a very funny idea of how to combine trades; try buying two nearby butterflies and watch what happens. It breaks them apart and recombines them into 2 call spreads, a butterfly, and a condor. Sheesh:

I've recently been trying OptionsHouse ... the low-price leader. They do get the job done, but ...

They're not as good at security as Interactive Brokers, but they do have a standalone program (runs on Windows, Mac, Linux) that is easier to secure than a browser-based setup. Its UI is complex but usable, and there are videos posted on its site that tell how to do anything I ever wanted to do.

So: I'm going to stop messing around with brokerages and just use TOS to make money ... although I hear Fidelity's site is nice ... :-)

As I learned, I came to be interested in slightly nonstandard trades and to understand what features are desirable in a brokerage. I've tried four different brokerages now, and three have what I consider to be fatal flaws (for my purposes, anyway), so that leaves me with the fourth, which I'll discuss at the end of this post.

I spent 2+ years trading via OptionsXpress. There's a lot to like about this site: the UI is in many ways very nice, automatically doing things for you that should be automated (like adjusting the expiration dates on a butterfly spread to match when you change one of the wings).

Its fatal flaw, though, is being too inflexible about not-quite-standard trades, like the 1-4-3 butterfly I mentioned here last year. It also has a very funny idea of how to combine trades; try buying two nearby butterflies and watch what happens. It breaks them apart and recombines them into 2 call spreads, a butterfly, and a condor. Sheesh:

I've recently been trying OptionsHouse ... the low-price leader. They do get the job done, but ...

- They have a clunky UI, with none of the nice features of the OX website. You have to do every step by hand, including assembling the sale of a spread that you bought.

- They have a strange way of handling not-quite-even butterflies -- they make them 2 spreads and apparently charge margin for each! For example, I tried to put in a butterfly 850-910-950 and got a "you don't have enough margin" message. I put in a help request and this '2 spread' bit was explained ... I widened the spread to 850-910-960, still a debit spread ... and the system accepts it.

These 2 issues I might have lived with, but this week I tried to put in a calendar on the new extended weeklies -- you sell the 8-day-out one and buy the 15-day-out one. This is a debit spread with limited risk, but I got this red warning text as if I were trying to sell naked calls. I called their help line and got some unhelpful explanation. I suggested this might be a bug in their system, and the guy said no, that's what they intended ... OK, they're going to have to live without me ...

I've just spent a couple of months with Interactive Brokers. I had high hopes ...

There is a lot to like:

- Terrific execution, even (especially?) of open-outcry index options like RUT and SPX

- The best security of any brokerage or bank I've seen, with a brilliantly designed two-factor authentication scheme

But ...

The UI is baffling. Actually they have at least 2 UIs and possibly more, depending on how you count. There is Web Trader, via which I entered my first butterfly spread. I then launched their "Trader Workstation" .. and it's a bunch of Java UI code flying in very loose formation.

What do I mean by baffling? I thought I was buying March 2013 expiration options ... there was a web menu that had 'Mar 2013' as one of the items but then some dates below that, presumably weeklies. I chose 'Mar 2013' and thought I was all good.

I found out two days later that I actually bought a spread on the March 1 expiration extended weeklies without realizing it! This is ... the second time I've made this mistake on their site, and two strikes is out.

I was going to insert a screenshot of the Trader Workstation menu ... but the first time I tried to run the Linux version:

The brilliantly designed two-factor authentication scheme is

missing one of the factors on Linux ...

So that leaves me consolidating with ... drum roll please ... ThinkOrSwim. To be abbreviated TOS below ...

I have only traded intermittently with TOS, trying other brokerages when I was experimenting with the 1-4-3 trade ... $179.95 commissions for a +10/-40/+30 trade ... $24.50 on OptionsHouse.

But:

- I got a break on the commissions through Dan Sheridan's company, and I'm no longer focusing on that 80-contract trade but a butterfly which takes only 40

- Other than the commissions, I realized earlier today that I've never had a single other issue with TOS!

They're not as good at security as Interactive Brokers, but they do have a standalone program (runs on Windows, Mac, Linux) that is easier to secure than a browser-based setup. Its UI is complex but usable, and there are videos posted on its site that tell how to do anything I ever wanted to do.

So: I'm going to stop messing around with brokerages and just use TOS to make money ... although I hear Fidelity's site is nice ... :-)

Monday, January 21, 2013

Probiotics is going Yuckily mainstream

I've been seeing 'Probiotics' mentioned various places for years. But this result is going to thrust it into the mainstream.

This way of looking at disease posits that there are not only microbial "germs" but a human biome that is largely protective of human health even when these normally pathological "germs" are present.

Broad-spectrum antibiotics kill not only the germ targeted but other helpful bacteria that are normally on "our side," the probiotics advocates claim.

It looks like they're right!

Clostoridium Difficle is a bacterium that causes severe intestinal disease ... but mostly among people who have been using antibiotics, often in hospitals.

A study just published trying the ancient remedy of fecal transplant: that's transferring fecal matter from a healthy person to one suffering from C. Difficle. The study group showed this technique to be so effective (15 of 16 patients helped) versus the control groups using standard antibiotic therapy (3 of 14 and 4 of 14) that the study was halted. It was thought to be unethical to continue when the study group was getting such profoundly better results.

The transplant apparently restores a full suite of helpful bacteria to the suffering patient, restoring C. Difficile to its rightful place in the background, causing no further harm.

Have some yogurt!

References:

The New York Times article

"Germs are Us" from the New Yorker

The Wild Life of Our Bodies

This way of looking at disease posits that there are not only microbial "germs" but a human biome that is largely protective of human health even when these normally pathological "germs" are present.

Broad-spectrum antibiotics kill not only the germ targeted but other helpful bacteria that are normally on "our side," the probiotics advocates claim.

It looks like they're right!

Clostoridium Difficle is a bacterium that causes severe intestinal disease ... but mostly among people who have been using antibiotics, often in hospitals.

A study just published trying the ancient remedy of fecal transplant: that's transferring fecal matter from a healthy person to one suffering from C. Difficle. The study group showed this technique to be so effective (15 of 16 patients helped) versus the control groups using standard antibiotic therapy (3 of 14 and 4 of 14) that the study was halted. It was thought to be unethical to continue when the study group was getting such profoundly better results.

The transplant apparently restores a full suite of helpful bacteria to the suffering patient, restoring C. Difficile to its rightful place in the background, causing no further harm.

Have some yogurt!

References:

The New York Times article

"Germs are Us" from the New Yorker

The Wild Life of Our Bodies

Subscribe to:

Posts (Atom)